Here's our profit sharing spreadsheet

It took me too long to begin a profit sharing program at Foojee. It wasn't the whole "giving money away" part that kept me from doing it, rather it was the complexity I assumed it was going to require to make it fair and consistent every year. I assumed wrong.

So I want to share the spreadsheet hoping it will help you implement a profit sharing program for your team. Your team is what makes your company possible, and I think profit sharing is a great way to materialize your gratitude to your team's effort.

The Goods

- Here's the link (you can download it in any format you choose): https://www.icloud.com/numbers/07cQn2cPnaKiQK3RxYtC314ZQ#Profit_Sharing_Calculator

- And here's the video walkthrough if you prefer: https://www.dropbox.com/scl/fi/w2cf30275urxtllupzp5z/Profit-Sharing-Walkthrough.mov

Prerequisites

Here are some things that will help make this spreadsheet useful.

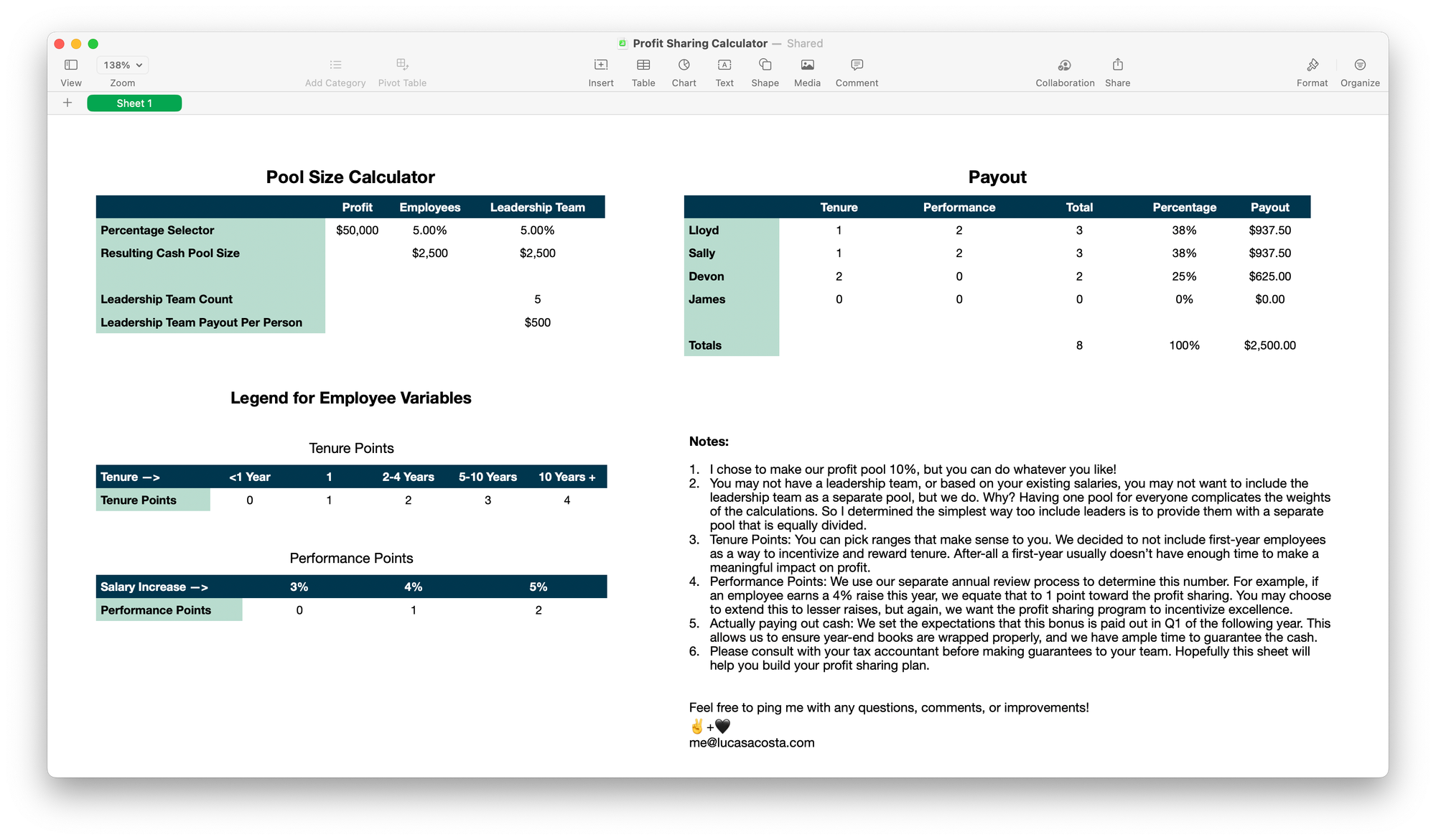

- Decide the amount of profit you want to share with your team.

- Annual performance reviews with your team. We decided to make the performance review score (basically their raise percentage) affect the profit sharing calculation. If you don't do performance reviews currently, you should! (Maybe that'll be an upcoming post.) In the meantime you can come up with a different variable in the spreadsheet. Using the employee's annual raise percentage helps us in two ways:

- It emphasizes the importance of the annual review (because it counts toward your raise and your profit sharing.)

- It simplifies this entire initiative. The less math we have to do, and fewer decisions we have to make, the more likely this can be repeated easily and consistently.

Variables in the spreadsheet to consider

It's not a complicated spreadsheet, but here's what you can change:

- How much cash you will have at the end of the year. (Or maybe you just have a pile of cash you want to throw in here.)

- How much percentage you want to share with your team.

- Whether or not you want a separate pool for your leadership team. We have a separate pool. Why? Having one pool for everyone complicates the weights of the calculations. So I determined the simplest way too include leaders is to provide them with a separate pool that is equally divided.

- How many people are on the leadership team.

- How you want to segment "tenure" blocks. i.e. 1-2 years, 3-5 years, etc. You can pick ranges that make sense to you. We decided to not include first-year employees as a way to incentivize and reward tenure. After-all a first-year usually doesn’t have enough time to make a meaningful impact on profit.

- How you want to quantify "performance" points. We use our separate annual review process to determine this number. For example, if an employee earns a 4% raise this year, we equate that to 1 point toward the profit sharing. You may choose to extend this to lesser raises, but again, we want our profit sharing program to incentivize excellence.

Final thoughts

When it comes to when the bonus is paid out, we set expectations for Q1 of the following year. This allows us to ensure year-end books are wrapped properly, and we have ample time to guarantee the cash.

Please consult with your tax accountant before making guarantees to your team. Hopefully this sheet will help you build your profit sharing plan.

What profit sharing practices have you implemented? Anything we can do to improve ours? Would love to hear from you!